Efosa Ojomo is a senior fellow at the Christensen Institute for Disruptive Innovation, where he leads the organization’s Global Prosperity Practice. Karen Dillon is a former editor of the Harvard Business Review and the bestselling coauthor of How Will You Measure Your Life? and Competing Against Luck. The two are coauthors, along with Clayton Christensen, of the Next Big Idea Club Spring Finalist, The Prosperity Paradox: How Innovation Can Lift Nations Out of Poverty. They recently joined Next Big Idea Club Editor Jeremy Price to discuss why simply sending money to poor countries isn’t enough, and how anyone can help those in need.

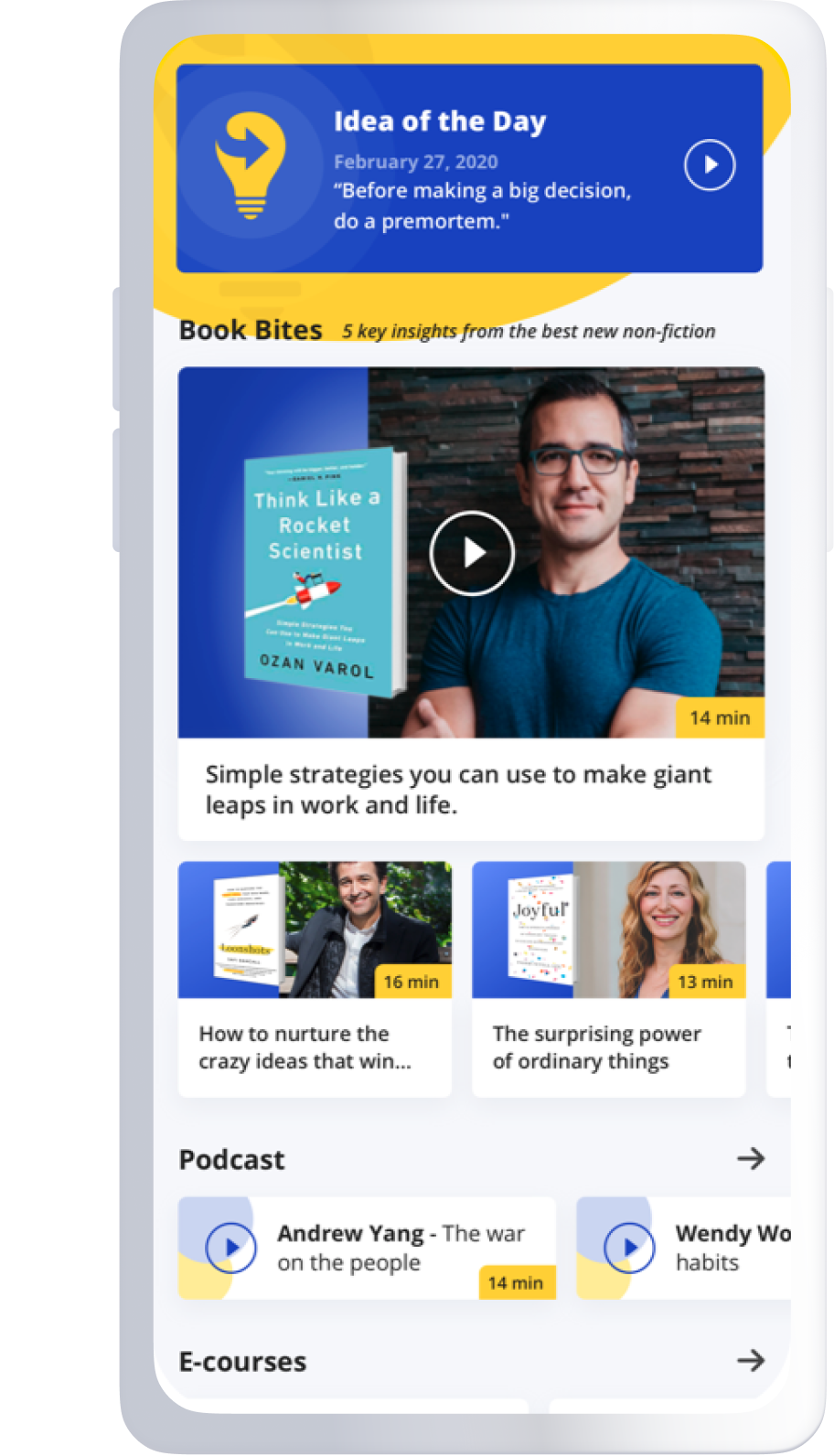

This conversation has been edited and condensed. To view the full version, click the video below.

Jeremy: You point out that most of the poorest countries in 1960 are still, even today, the poorest countries in the world, despite the fact that the U.S. and other countries have pumped literally trillions of dollars into assisting them. Why is it that this aid money doesn’t seem to have worked?

Efosa: Most development programs fail to create robust prosperity because they’re really designed to fix or alleviate poverty, not create economic development. That’s what we call the “prosperity paradox”—the more you try to fix poverty, the more you worsen it. It’s by focusing on creating prosperity that you can actually fix poverty and create robust economic development.

Karen: You can liken it to treating the symptoms of a disease, rather than getting to the root cause of the disease. These organizations contributing aid money have really good intentions, and they are temporarily easing some of the pain points that we see in poverty—but prosperity is the desired outcome, not just not poverty. They’re different things. A robust economy where people can rise and have a better quality of life is something that comes from generating prosperity, not simply alleviating the symptoms of poverty.

Efosa: One of the examples we talk about in the book was my own failure. In 2008, I got some friends together to start a nonprofit and help African communities build wells. I go into a few communities in Nigeria, we raise tens of thousands of dollars, and we build wells.

But my focus was to provide water, to alleviate poverty; to Karen’s point, that was just fixing the symptoms. A few months go by, and when I’m back in the U.S., I get a call that the wells are broken. That situation was a microcosm of the bigger development industry, and you can begin to see why many of these programs might temporarily help, but they don’t create this robust development and prosperity we’re all looking for.

Jeremy: Yeah, that makes a lot of sense. Poverty frequently manifests as a lack of food or water, and there’s such an urgency to those things that I can totally understand the impulse to be like, “We’ve got to get these people water! The rest will take care of itself.”

In the book, you write about the value of market-creating innovations, and how they are much more effective than simply providing food or water. They may even be a solution to the prosperity paradox. Can you give me an example of what a market-creating innovation looks like, and how it works?

Efosa: A market-creating innovation is simply an innovation that transforms a complicated and expensive product into something that’s simple and affordable, so that many more people in society can have access to it.

A perfect example of this is 20 years ago, there was an entrepreneur by the name of Moe Ibrahim. He looks at the landscape in Africa and says, “You know, this is a continent of 800 million people, and fewer than 10 million have phones. Let’s go to Africa, build some cell towers, and sell some phones.”

And his colleagues just laughed. They were like, “There’s no way this could ever work. These people are corrupt, they’re poor, they have AIDS.” But he kept seeing people struggle to communicate with friends, family, and colleagues. If [an African villager] wanted to go visit his mom, he would sometimes have to trek for days to the village where she lived. So Moe left his job in the U.K. and decided to start building the cell phone infrastructure in several African countries. In seven years, his company was grossing over half a billion dollars, and he was able to sell it for $3.4 billion.

And what really excites us about market-creating innovations is all the things they trigger in the economy. 20 years after Moe decided to build cell phone infrastructure, the mobile telecommunications industry in Africa now supports close to 4 million jobs. It’s estimated to provide anywhere from 150 to 200 billion dollars in economic value, and it provides billions of dollars in taxes to many poor African governments every year. These are taxes that these governments can then reinvest to build the nation’s infrastructure, to build the nation’s institutions, schools, hospitals, and so on. So market-creating innovations aren’t the only thing you need, but when you invest in them and get them right, they create a beautiful domino effect that can transform billions of lives.

“Prosperity is the desired outcome, not just not poverty. They’re different things.”

Karen: I’ll also give you an example of the power of market-creating innovations. 150 years ago, the United States was as impoverished as some of the countries we now point to on those global charts. We had child labor, and people spending most of their income on food just to survive.

But market-creating innovations started to change all that. Henry Ford and his automobile, Isaac Merritt Singer and the Singer sewing machine—things like that not only made a product affordable and accessible, but also had that domino effect of creating jobs and even other industries, helping to build the infrastructure of the entire country. America is a great example of how quickly and dramatically those innovations can change an economy’s trajectory.

Jeremy: It seems that you’re arguing that prosperity depends on consumption, but some thinkers out there, like Rutger Bregman for example, are big proponents of universal basic income. So is consumption really the only way to do it, or are there other paths to prosperity?

Efosa: That’s a great question. So there’s a couple of questions we have to ask about universal basic income: Number one, where is this money going to come from? And number two, what are people going to use the money for? Ultimately, they’re going to use it to consume—health, education, housing, food, things like that. Those might be interesting value distribution mechanisms, but you have to create that value somehow. It cannot come out of thin air.

In today’s world, we talk a lot about income inequality, and capitalism gets a really bad rap. I try to remind people, “Look, let’s not throw the baby out with the bath water. Let’s try to understand the idea of creating value first, and [then] distributing value.” The fact that a lot of the value that’s been created over the past 50 years has gone to the top 0.1% is different from the fact that the fundamental way you create value in society is by solving people’s problems in a way that’s productive and profitable. Let’s divide the two, and then try to solve for each.

Karen: There are other ways to solve the problem—we don’t have every answer to every question. But what we do know is that this has worked over centuries. We can see the historical pattern, and it’s working now. It’s a proven path to prosperity, and thus worth being taken seriously.

Jeremy: Absolutely.

Another theme of your book is that in crisis there can be opportunity. There’s one really interesting example that you write about—the “McDonald’s of diabetes care” in Mexico. Would you mind going into that?

Karen: Sure. There was a Mexican man named Javier Lozano, who had come to the United States for his graduate degree. He registered in a course that Clay Christensen was teaching at Harvard Business School, and one of his projects was to work on diabetes technology. He became enamored with the technology, and what was possible at the top of diabetic care.

His own mother in Mexico was a Type II diabetic, and he called her enthusiastically, saying, “Did you know about all this cool stuff that you can do for your diabetes?” She had had a lot of trouble controlling her diabetes, and was feeling really despondent about it. And as she listened to him bubbling on about his own cool technology, it occurred to both of them that this was not even imaginable in her life in Mexico. Diabetes is one of the leading causes of death in Mexico right now, and it clicked for Lozano that it had been difficult to get good care for Type II diabetics, and that there just had to be a better way.

So what he did was set up a series of clinics. Instead of having to go to all these different doctors—making different appointments, never feeling in control, and never fully understanding what’s happening to you—[patients] could go into these specialized clinics and get seen at seven or eight different stations that you need to take care of your diabetes. And the annual membership fee was affordable for most people.

“The fundamental way you create value in society is by solving people’s problems in a way that’s productive and profitable.”

The day he opened his doors for the first time, his mother was mad because she wasn’t patient number one—there were other people already ahead of her in line! It was a market-creating innovation that made it affordable and accessible for real people to get much better control of their care.

Efosa: In the same way many of Moe Ibrahim’s colleagues laughed at him, Javier Lozano had a bunch of people saying that it was never going to work. But his solution cost roughly $250 a year [for patients, compared to] the thousand dollars they spent visiting so many different hospitals. You literally walk into any of his clinics—they all look the same—and you get care from trained professionals. Today, not only is Lozano the country’s largest private-sector provider of diabetes care, but he has also inspired a bunch of copycats.

If you play this out over the next 20 years like we did with Moe Ibrahim, you can imagine the impact this could have on the Mexican healthcare landscape. If every single person who is struggling with diabetes now has a clinic that’s close and affordable, think about the jobs that will create. Think about the impact on public health. Think about how they might apply the principles used to solve this problem to other healthcare ailments. When you look at it through the lens of market-creating innovation and Mexico as a whole, you’re like, “Wow, this is transformative.” It can change nations.

Karen: I just want to add one fun detail—the clinic realized early on that patients sometimes would get a call from a nurse or a doctor to check in: “How are you doing?” But they would fib or lie—“I’m taking my medicine,” “My blood sugar numbers are really good,”—because they were too polite [to tell the hard truth].

Lozano’s mother realized that people need to talk to them, people who really understand. You can’t have a person in a white coat calling to ask if you’re complying with your strict controls. So his mother now works in the office with him, and is in charge of checking in and patient one-to-one counseling. She has gone from feeling despondent about her future to being enthusiastic, and actually helping [shape] the market-creating innovation that probably played a role in saving her own life, and certainly will play a role in saving many more lives in Mexico.

Jeremy: What a great story that is. And it illustrates that capitalism doesn’t have to be a zero-sum game. As you mentioned, Efosa, capitalism often gets a bad rap. There’s this perception that capitalism has to mean that the 1% is exploiting the 99%, that that’s just inherent in the system. But it doesn’t have to be. In that example, Lozano saw a need and he started a program. Yes, people were paying for it, and it did make him some money. But at the end of the day, their lives were significantly improved, healthcare got better, and society as a whole was enriched.

Efosa: Absolutely. One of the things we write about in the book is that nobody gets fired for building a well. I mean, if you go and tell your buddies, “Hey guys, lots of people in Africa don’t have water. Let’s raise money and build a well,” they’re going to think you’re a saint. [But if you say,] “Hey guys, I’ve come up with this new product that we can sell to people who make less than three dollars a day,” they’re like, “Oh, Jeremy, how could you? That’s so mean.” But in creating a market, people’s lives improve. They get jobs, and they can take care of themselves and their families. It’s a beautiful story, I think, of how societies can evolve with dignity.

Jeremy: One of my favorite thinkers, Jaron Lanier, writes a lot about economic dignity as well, and it strikes me that that’s a real advantage of this approach. You’re putting the locus of control in the hands of the everyday person, and I think that’s a really powerful thing.

I wanted to close with the question of, what can we do? Not all of us have the money to invest in a brand new company, and not everyone has the ability to start one themselves. So what can the average person do to help lift nations out of poverty and into prosperity?

“Capitalism doesn’t have to be a zero-sum game.”

Efosa: That’s a brilliant question, and it’s one that we are still grappling with. If you had asked me what Bill Gates can do, I’d simply tell him to go build a bunch of Microsofts in many of these countries, and over time, these countries would not need the Gates Foundation anymore.

But as for what the average person can do, I think that awareness of how these mechanisms work is important, because not all charities or NGO’s are created equal. If we can only afford to give $20 a month or $20 a year, we can investigate what each organization is doing to help these regions. [Are they] giving a man a fish, or teaching a man to fish, [so to speak]?

The other thing that people can do is, if you’re able, visit these countries, invest in these countries. One of the things that can quickly change stereotypes is engagement. So we might think, “Oh, they’re helpless.” But when you visit, you see that these are some of the most industrious people in the world—it’s just that not everybody is equally endowed.

Karen: I would add that we talk about a lot of international examples, but the same principles apply here in the U.S. as well. Many parts of the country are struggling from having been in a previous age of glory. But market-creating innovations are not based on geography—they’re based on helping people get out of things that they’re struggling with in their lives. So you don’t have to travel to Nigeria to see opportunities—the same thinking holds true for those of us here in America. And I think that’s very powerful to think about.

Ready for more big ideas like this? Join the Next Big Idea Club today!