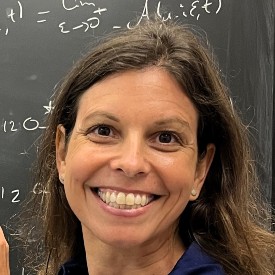

Lauren Simmons made history at the New York Stock Exchange as the youngest female trader and the second-ever African American woman in the NYSE’s 231 years. She received her bachelor’s degree in genetics from Kennesaw State University. Lauren is the host of the Money Moves podcast on Spotify and has been featured on ABC, CNBC, CNN, Fox, and other media outlets.

Below, Lauren shares 5 key insights from her new book, Make Money Move: A Guide to Financial Wellness. Listen to the audio version—read by Lauren herself—in the Next Big Idea App.

1. Get your mind right.

Our minds possess power beyond imagination. Sit with those words, feel those words, and I want you to say those words out loud again. Our minds possess power beyond imagination. If your mind is not in a good place, then you won’t be able to unlock all the treasures this world has to offer you. This isn’t just wishful thinking. This is about making the shift. You know yourself better than anyone else. You have all the answers you need to make decisions that are right for you.

People in this world have good intentions, but through their life experiences, they will go out of their way to pull you down, often out of protection, or because they just don’t want to see you win. Listen to your North Star. Sharpen your tools so that you are making decisions that feel good for you. Eliminate listening to individuals who project their fears onto you. We will stop listening to people that condition us to live with a fear-based mindset, or to live and lack.

Something that I learned on the exchange floors is that we have to make decisions in microseconds, and whatever decisions we make, we have to own, good or bad. You get better at making decisions once you understand who you want to show up as in this world. This is a muscle you have to continue to work out. These are practices I have implemented in my life over the past 10 years and will continue to do so.

I was great at self-sabotage, but over the past years, I have learned to change my inner critic to empower, uplift, and motivate me. If you aren’t your biggest cheerleader, why would you expect anyone else to come close? If you were in that place currently, it only takes a few steps and consistent practice to really make your mind work for you in a positive way. But remember, this is a marathon, not a sprint. This journey doesn’t just stop when you get to a good place. I’m still implementing all of these tools in my day-to-day.

“Good or bad, you are always exactly where you’re meant to be.”

The most powerful thing you can do is work on a relationship with yourself. When you know yourself, truly know yourself, the possibilities are infinite. I also want you to know is that you are always exactly where you’re meant to be. Good or bad, you are always exactly where you’re meant to be.

My journey to the New York Stock Exchange wasn’t linear by any means, but one of the things that often was asked by Richard Rosenblatt of Rosenblatt Securities was “Why Lauren? Why did you choose her? Especially because she did not go to school for finance.” Something that has stayed with me is his answer, “Lauren, out of all people, ended up at the New York Stock Exchange. There are people who have worked their entire lives in finance and have never stepped foot at the New York Stock Exchange. There are people that have gone to school for finance, have networked with all the ‘right people’, and yet Lauren made her way to the New York Stock Exchange without even knowing what the position called for.” He would go on to say, “She was exactly where she was meant to be, there was a higher being that put Lauren exactly where she needed to be.”

Just know that you are always exactly where you’re meant to be. Even if at this moment you don’t want to be wherever you’re at, know that you can make the shift and the shift can happen gradually—or instantly—but you are always making the shift of where you’re exactly meant to be.

2. Find your financial wellness.

Here’s a big secret, investing in the traditional stock market isn’t the only way to grow your money. In fact, while working on the floor of the exchange, 90 percent of the men didn’t invest in the market. There are so many different asset classes to invest in (and it’s okay if you don’t know what asset classes are.) You can invest as small or as large as you want, but it’s not about jumping in and investing. In my personal journey, I waited two years after I left the floor before I made my first investment. It wasn’t because I couldn’t invest while I was on the trading floor. It was because I really wanted to understand what it meant to invest.

There is so much noise in that you need to invest now, right now. The truth is, if you don’t have the financial literacy to invest or you’re investing with emotions, you aren’t going to be making savvy decisions. With investing, there is a harsh truth; when we invest, we’re not investing for tomorrow and expecting to get a hundred percent return tomorrow. We are investing for the future. This is a marathon, not a sprint. If you are looking to get returns tomorrow, that is called gambling. We are investors and we are investing for the long term. Long-term, by definition, is anything over 12 months. Short-term is less than 12 months. I am not a short-term investor kind of girl. I am a long-term investor kind of girl.

3. Say yes.

Here are some truths for you to carry. Only 32 percent of people go into the field in which they major in. Allow yourself to be open to opportunities. Guess what? If it isn’t morally or ethically compromising your beliefs, just say yes. You don’t need to know what your forever job will be. Actually, more likely than not, you won’t even have a forever job. People will change their jobs two to three times throughout their lifetime.

At all times, try to have fun in your job. Continue learning your role and pushing yourself to take risks. The biggest growth I’ve seen in my career is saying yes to opportunities that I honestly would not have imagined saying yes to.

“Only 32 percent of people go into the field in which they major in.”

For instance, I was asked to speak on stage in front of 10,000 people, with severe stage fright Today, I’m a global motivational speaker. To take a job as an equity trader, without knowing what an equity trader does, or what an equity trader is. I said yes, and I would go on to make history.

When you learn how to strategically network and get outside of your head, there is always someone else who sees you in a role or an opportunity that you would have never envisioned for yourself.

4. Money and dating.

It’s interesting how in dating we could talk about so much—politics, relationships, all of it—but money is typically taboo. It’s crucial to take a deep dive into having the money talk and being financially compatible.

Money and communication are the number one and number two reasons why relationships don’t work. My work over the years has shined light on people and why their relationships are not working. Many are not having the money conversation or having the money conversation far too deep into a relationship, later realizing that they aren’t financially compatible.

This isn’t about finding your forever person. Maybe you’re in college and you need to get through school. Maybe you are casually dating, or maybe you are really trying to find your forever person. Regardless, we need to be having the hard money conversation and get honest about our needs and expectations and what we’re willing to compromise on. The more honest you are about your needs upfront, the better you can set expectations, and the better you can be informed.

5. Mind, body, money.

These are all interconnected, and we’re going to get your mind right. We’re going to use our body as a temple. And we’re going to lock into a wealth mindset. We can make our money move. You can learn to be open, flexible, and honest with all three of these things. You can learn new ways to develop and grow yourself and to grow your money habits. Don’t forget about the small, simple steps.

To listen to the audio version read by author Lauren Simmons, download the Next Big Idea App today: