Mark Blyth and Nicolo Fraccaroli are colleagues at Brown University. Mark is a Professor of International Economics and of International and Public Affairs, as well as Director of the William R. Rhodes Center for International Economics and Finance. Nicolo is a visiting scholar and, beyond Brown, he is an economist at the World Bank.

What’s the big idea?

Inflation does not affect everyone equally. Some people get hit very hard by inflation, whereas others may even stand to benefit from such periods of time. Unfortunately, most of us are inflation losers. By understanding how inflation actually works, we can anticipate what it takes to be a winner.

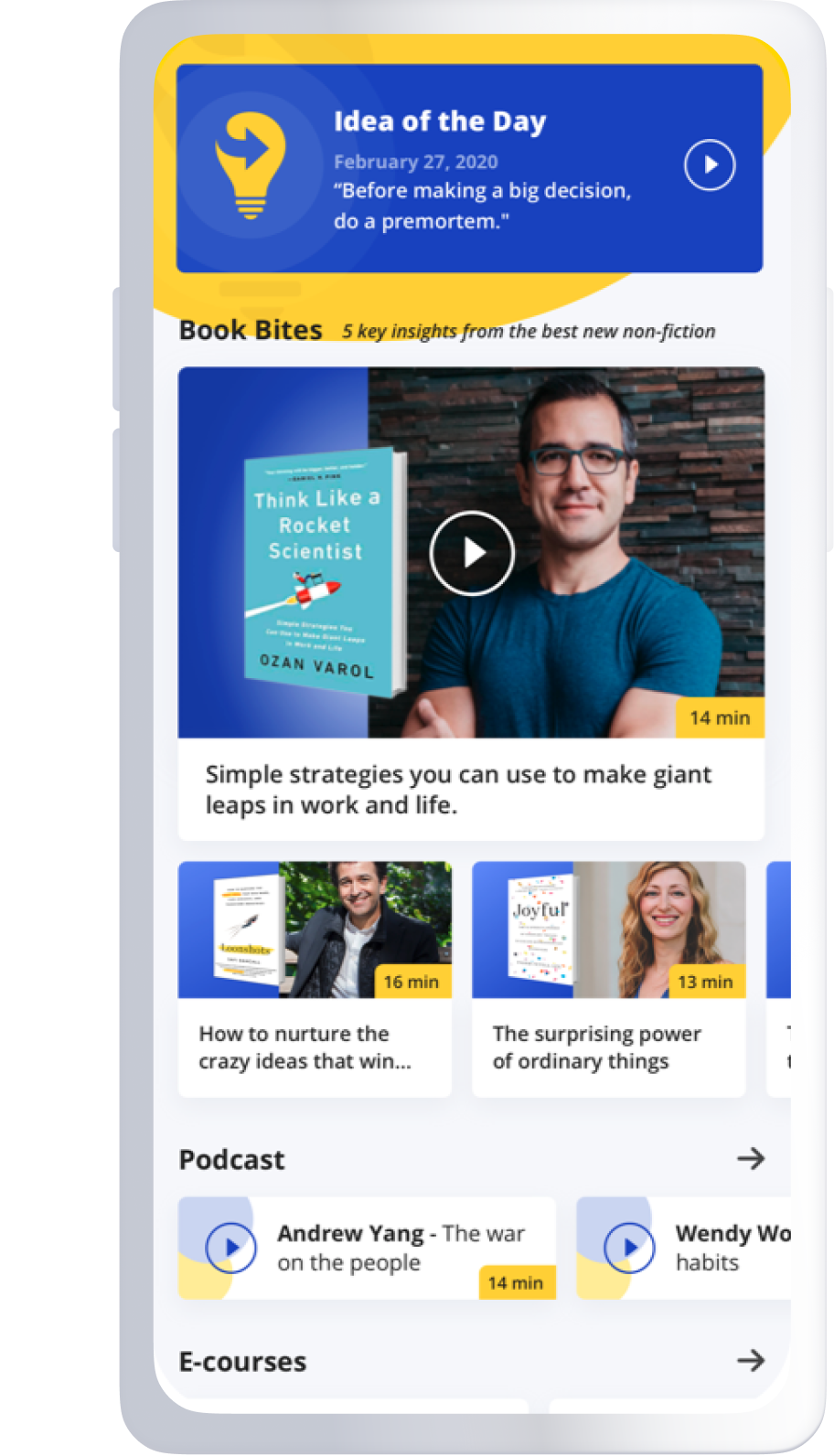

Below, co-authors Mark Blyth and Nicolo Fraccaroli share five key insights from their new book, Inflation: A Guide for Users and Losers. Listen to the audio version—read by Mark—in the Next Big Idea App.

1. Inflation can be confusing.

What economists think inflation is and what normal people think inflation is can be quite different things. Inflation is a “rise in the general level of all prices.” It’s not when houses get more expensive or the price of gasoline goes up; it’s a general rise in the level of all prices.

That seems pretty straightforward, so why the confusion? Think about the economy as a glass of water. Economists look at the thin line at the top of the glass (the surface tension) and examine how it has changed over time. They focus on the rate of change in prices. The public instead looks at the amount of water in the glass and notes that it has gone up and is not coming down. They look at the level of prices.

That creates a world where economists can say, “Inflation has decreased by X percent,” while normal people can say, “Are you kidding? Eggs are still twice what they used to be,” and both can be correct. One looks at the rate of change and the other looks at the level.

A similar confusion comes from the fact that inflation is measured by a price index. That’s how central banks keep track of thousands of purchased items (80,000 in the case of the Fed), noting if they increased or decreased, and averaging all those changes into a single number—the inflation rate. To make this number more comparable across time, these folks remove items that jump around a lot, like food and fuel.

The problem is that normal folks, especially those who find themselves in the bottom 60 percent of the income distribution, spend a big chunk of income on food and fuel, so removing those creates a disconnect between what people personally perceive as inflation and what the official figures say. This is why subjective experiences of inflation may be more accurate.

2. Not everyone suffers from inflation.

How inflation impacts you depends upon how much income you have. If you shop at Dollar General and prices go up ten percent, you will have to make hard choices about your family budget. In contrast, if you shop at Whole Foods, you literally don’t care about inflation if you are willing to overpay that much to begin with.

What matters is how much of your income goes to consumption. If you are in the bottom half of the income distribution, then a large chunk of your income is spent on consumption items such as food, fuel, and rent. Inflation acts as a tax on consumption, so the more you consume relative to your income, the more it hurts. You are an inflation loser.

“What matters is how much of your income goes to consumption.”

If you are in the top ten percent of the income distribution, you proportionately spend less of your overall income on consumption. And you probably have a mortgage rather than pay rent, which is building an asset rather than consuming. Congratulations, you are an inflation winner.

Just as different individuals win or lose according to their income level, so do firms according to how inflation affects their products. Firms in markets with few competitors try to take advantage of the confusion that exists over what prices should be to raise their prices beyond what they would normally get away with.

Economists assume that such ‘price-gouging’ can’t happen because competition between firms would mean that if a firm raised prices, then another one would cut theirs in response and take the price-hiker’s market share. However, many markets, ranging from eggs to cereals to oil and gas, have only one or two suppliers, resulting in a lack of competition. According to the European Central Bank, some 40 percent of the inflation in the EU in 2022 was caused by firms jacking up prices. They win. You lose.

3. Tools that fight inflation also create winners and losers.

The ever-ready hammer for the nail of inflation is always to raise interest rates. Central banks like to pretend that monetary policy is technical and neutral. They like to say that they don’t pick winners and losers. In contrast, what politicians do—fiscal policy—requires picking winners and losers as they make decisions over who to tax and who to spend money on. It turns out, this is not true either.

When prices go up, central banks raise interest rates to cool the economy, and your income level really matters for how this impacts you. If you are poor, then you probably already pay much more for your credit than a rich consumer, so raising rates from a higher baseline doubly impacts your consumption. If you are wealthy, you typically pay less for your credit, and you likely own interest-bearing assets, such as bonds and other investments, that earn more from higher interest rates.

“The notion that we all pay the price simply isn’t true.”

The very act of hiking rates rewards savers and punishes borrowers, which is the definition of picking winners and losers. Whether this is the “price to be paid” for killing inflation is a legitimate question. But the notion that we all pay the price simply isn’t true.

Some firms and individuals really make out like bandits on inflation. They are the mega winners. By one estimate, U.S. oil companies made $220 billion in excess profits in 2022. And if you happen to live in the top one percent of the U.S. income distribution and are therefore among the folks who hold half the shares in the stock market, you would have received half of that number back in those share prices going up, and the dividends paid by those companies.

In contrast, while ordinary folks’ nominal wages went up across the board in most countries because of inflation, their real wages (their wage minus inflation) never matched the increase in prices. The vast majority of us are inflation losers.

4. How we think about inflation shapes our response to it.

Much of our thinking about inflation is rooted in the 1970s, when the country experienced its last major outbreak of inflation. Policymakers and economists think of that period as being caused by two main mistakes: the government printing too much money and workers demanding high pay increases. The take-home lesson was that inflation rose because people came to expect prices to keep rising, and so central banks had to be willing to raise interest rates (even at the price of creating unemployment) to get those expectations back down.

It’s a good story, but it may not be quite right. First of all, we no longer live in the 1970s. The economy today is completely different from back then in terms of what is made and what is consumed. Today, less than ten percent of workers are in unions, and, for many people, real wages have been stagnant for decades. If prices are going to rise, it’s not coming from there.

“It’s a good story, but it may not be quite right.”

Second, much of the reduction in inflation since the 1970s has been due to factors such as the addition of half a billion Chinese to the global labor supply, which has enabled corporations to both lower prices and boost profits. Globalization, as it is called. That way of doing things may be on the way out, and with it its deflationary impulse.

Third, do people really have systematic inflation expectations? Different people have quite different inflation expectations. Today, one of the biggest drivers of that difference is which party you support. If you are a Republican in a Democratic presidency, you expect higher inflation. When the Republicans are in power, Democrats expect higher inflation. Those expectations themselves may in part drive inflation. In such a world, the ability of central banks to control inflation with interest rates is probably more limited than we like to think.

5. We are probably in for a more inflationary future.

Not because of greedy unions or inflated expectations, but because most inflations are caused by supply shocks. Like COVID, when global supply chains shut down causing all sorts of shortages that pushed up prices. Or like Ukraine, when Russia’s invasion caused gas prices in Europe to go through the roof.

When a supply shock happens, it’s not clear that raising the price of borrowing money is the best response. And there may be many more such supply shocks on the way. The Trump administration’s belief in tariffs to reindustrialize America is a policy-driven supply shock. If they are permanent, it means fewer imports, and those that remain will be more expensive.

In a similar vein, although the Trump administration doesn’t believe in climate change, its effects continue to drive up prices. Whether it’s in our food baskets due to crop stress or food-web degradation, or the rising cost of insurance as “once in a hundred years” fires and floods become “every other year” events, these supply shocks will likely become more frequent. If so, we will live in a more inflationary world, and in such a world, it’s more important than ever to determine who wins and how not to be a loser.

Enjoy our full library of Book Bites—read by the authors!—in the Next Big Idea App: