Dan Schulman is a New York Times best-selling author and journalist. He is the deputy Washington bureau chief of Mother Jones.

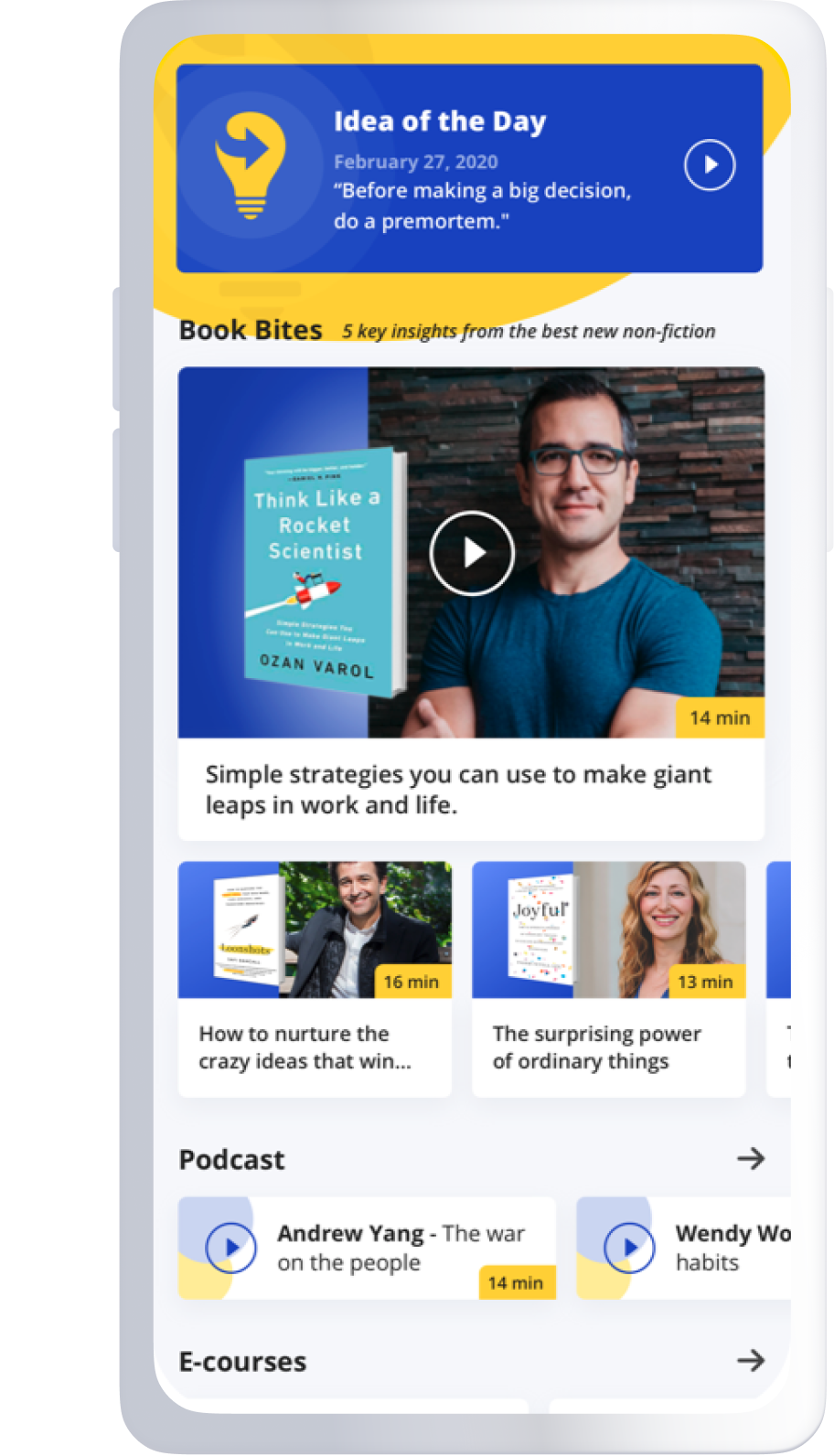

Below, Dan shares five key insights from his new book, The Money Kings: The Epic Story of the Jewish Immigrants Who Transformed Wall Street and Shaped Modern America. Listen to the audio version—read by Dan himself—in the Next Big Idea App.

1. Immigrant peddlers built some of the nation’s mightiest financial firms.

You’re probably familiar with the Horatio Alger, up-from-nothing archetype. Well, it’s helpful to know that in the late 1800s, Alger lived with Joseph Seligman and tutored the banker’s sons. Alger spent many evenings talking with Seligman and soaking up his incredible (and yes, Alger-esque) story.

As a teenager, Seligman immigrated from Bavaria. In those times, throughout Germany, Jews were treated as an underclass. They were barred from any but the lowliest jobs, often prohibited from owning property, and restricted in where they could live. These oppressive conditions propelled Joseph, like many other German Jews, to the United States during the 19th century.

Joseph quickly fell into the most popular startup position for Jewish immigrants in the mid-1800s: peddling. The great-grandson of one of the founders of Lehman Brothers called peddling the Harvard Business School for Jewish boys. It offered a crash course in business, the English language, and American customs. To be successful, you had to build rapport with customers quickly. You had to be resourceful. Adventurous.

“The great-grandson of one of the founders of Lehman Brothers called peddling the Harvard Business School for Jewish boys.”

Peddling was also how Henry Lehman (the first Lehman brother to immigrate) got his start. The same is true for Marcus Goldman of Goldman Sachs and Abraham Kuhn of Kuhn Loeb. Their firms would become some of the biggest names on Wall Street, but these banking empires were born out of 100-pound rucksacks and overloaded horse-drawn carts.

The partners of these firms would eventually form very close professional and personal ties, whose businesses had evolved in similar ways. Once their founders had built up enough capital through peddling, they opened dry goods and clothing firms. Then came the Civil War. It required large-scale bond-selling operations on both sides. That hastened the financialization of American life. In the war’s aftermath, these entrepreneurs quickly realized the opportunities in finance and were already well-positioned to leap into banking.

Collectively, they would help to capitalize some of America’s most iconic companies. They would finance the railroad system. And they would organize some of the nation’s first commodities exchanges.

2. The most influential financier of the Gilded Age is not who you think.

J. P. Morgan is widely considered the greatest banker of the Gilded Age—perhaps even the most pivotal financial figure in American history. But his contemporary and competitor, Jacob Schiff, could easily assert a claim to that title.

Born in Frankfurt, Schiff did not fit the mold of the earlier wave of Jewish immigrants. He hailed from a prosperous and well-regarded family within Frankfurt’s Jewish community. He arrived in the U.S. shortly after the Civil War. Before he was 20, he had co-founded a brokerage. He would soon marry into the Kuhn Loeb banking dynasty and became its most important partner.

For nearly 50 years, Schiff headed Kuhn Loeb, which would eventually merge with Lehman Brothers. These names are not well remembered today, but they once operated at the very highest strata of American finance, alongside Morgan’s firm.

Schiff helped channel millions, perhaps billions, in European investment capital into American industry—especially the railroads. One of his signature feats was the turnaround and restoration of the bankrupt Union Pacific. He was also a banker to corporations such as Westinghouse and Western Union. He played a vital role in transforming the United States from an emerging market into an economic superpower.

3. Jacob Schiff and his allies are why a thriving Jewish community exists in America today.

Schiff’s philanthropic legacy transcended his financial impact. Between 1890 and 1920, the Jewish population of the United States swelled from 400,000 to 3.4 million. This flood came from Eastern Europe and the Russian Empire. These immigrants were fleeing oppressive living conditions and mob violence targeting Jewish communities.

“They anticipated the immediate needs of new Jewish arrivals and facilitated their rapid Americanization.”

For years, Schiff and his fellow philanthropic stewards—including members of the Goldman, Sachs, Lehman, Seligman, and Warburg families—beat back nativist efforts to block Jewish immigration. To ensure these new arrivals would not become public charges, Schiff and his allies shouldered a weighty obligation to take care of their own. They poured millions into job training programs, schools, hospitals, English lessons, and many more services and organizations specifically geared toward the Jewish community. They anticipated the immediate needs of new Jewish arrivals and facilitated their rapid Americanization.

Many of the organizations that Schiff nurtured still exist to this day. If you come from a Jewish family with Russian or Eastern European roots, there is a good possibility your American story would not have been possible without Schiff.

4. German Jews played a profound role in developing the modern U.S. economy.

The progressive income tax, the federal reserve, the modern IPO—members of German Jewish financial dynasties played a part in these formative developments.

Edwin Seligman was a Columbia economist and the son of banker Joseph Seligman. He was integral to the effort to ratify the 16th amendment, authorizing an income tax. He was one of the intellectual forefathers of progressive taxation, on which our current tax system is based.

When Paul Warburg of Kuhn Loeb came to the U.S. in the early 1900s, we still lacked a central bank. Our currency was inelastic (it did not contract or expand based on demand), which meant frequent financial shocks and bank runs. Warburg led the push for a central bank. He was one of the architects of the Federal Reserve System and served on its first board.

“Sears and Woolworths were just a sampling of the many household-name businesses that grew and thrived as a result of their financial innovation.”

Henry Goldman and Philip Lehman were childhood friends. Together, they formed an alliance between their family firms to underwrite businesses ignored by the top investment banks. This included retailers such as Sears and Woolworths.

J. P. Morgan & Co. and other major firms concentrated on railroads and industrial concerns, whose share value was pegged to their physical assets. However, Goldman and Lehman believed intangibles, such as future earning capacity and goodwill, should be factored into share pricing. They helped pioneer the modern IPO. Sears and Woolworths were just a sampling of the many household-name businesses that grew and thrived as a result of their financial innovation.

5. Antisemitic myths about Jewish bankers seeking world domination are Henry Ford’s fault.

When a New York Times reporter visited Adolf Hitler in 1922, he noticed a large portrait of Henry Ford on his office wall. German translations of a book with Ford’s byline littered a table in the anteroom. It was titled, The International Jew: The World’s Foremost Problem. The book anthologized articles from Ford’s Dearborn independent newspaper. With Ford’s blessing, the paper had launched an antisemitic crusade that spanned seven years and 92 issues.

The paper’s frequent targets were German-Jewish financiers, whom Ford baselessly blamed for fomenting World War I. Week after week, the paper amplified the message and themes of the touchstone of modern antisemitism, the fraudulent tract known as The Protocols of the Elders of Zion.

Hitler and other Nazi leaders counted Ford as an inspiration. The automaker played a central role in amplifying many of the tropes, stereotypes, and conspiracy theories that plague Jewish people today. Ford’s antisemitism is often portrayed as a footnote to his career, but it was actually the defining feature of his legacy.

According to a Ford executive, Ford did reckon with the lethal hatred he stirred up. During a screening of a U.S. government film depicting the liberation of a concentration camp, Ford suffered a major stroke and died a few months later. “The virus had come full circle,” the Ford executive said of the industrialist.

The tycoons of that era paved the way for the modern world in fascinating ways. Once you start looking, you see their imprint all around us.

To listen to the audio version read by author Dan Schulman, download the Next Big Idea App today: