Scott Rick is an author and a marketing professor at the University of Michigan’s Ross School of Business. He holds a PhD in Behavioral Decision Research from Carnegie Mellon University, where he was a National Science Foundation graduate research fellow.

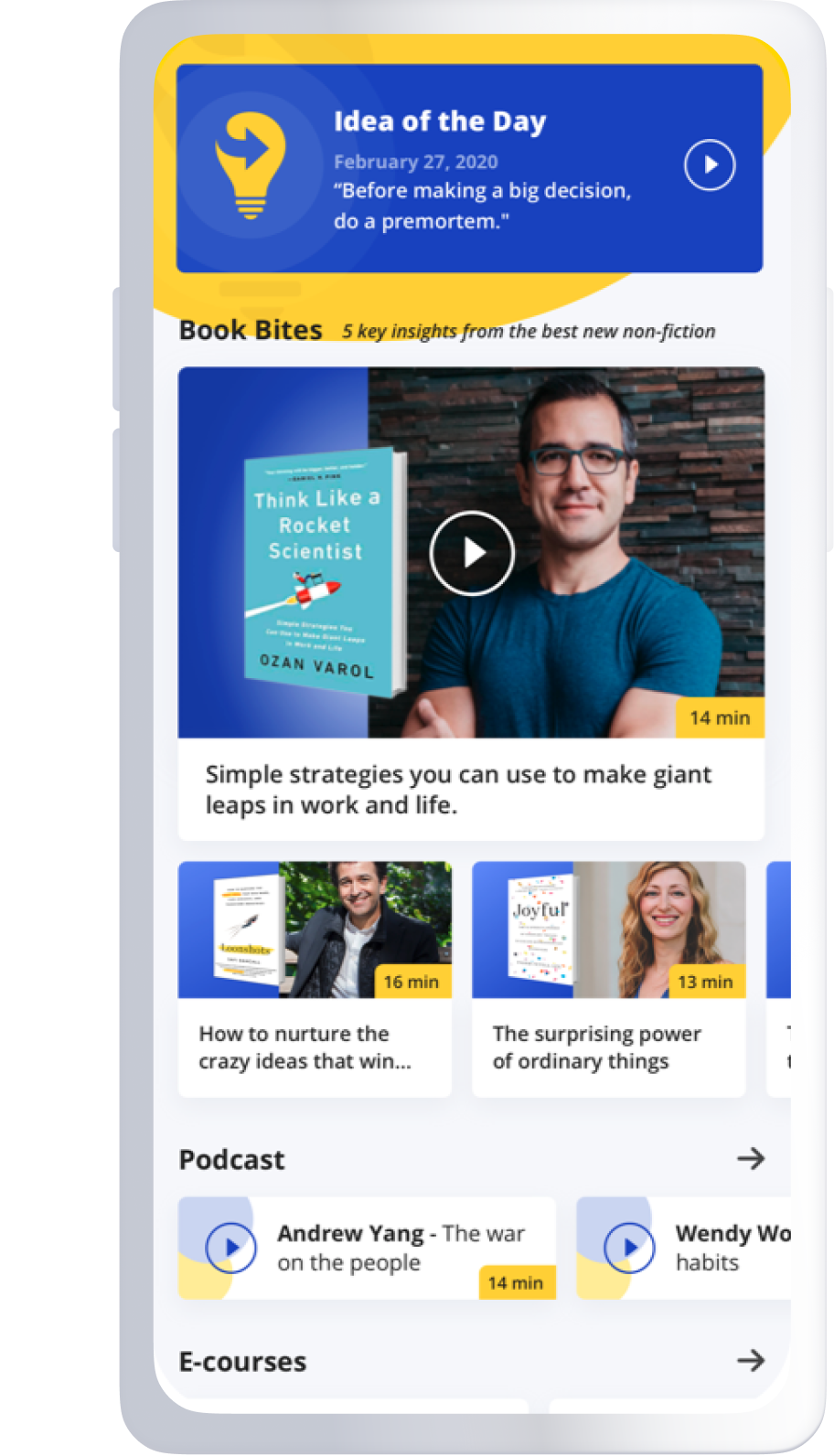

Below, Scott shares five key insights from his new book, Tightwads and Spendthrifts: Navigating the Money Minefield in Real Relationships. Listen to the audio version—read by Scott himself—in the Next Big Idea App.

1. Tightwads and spendthrifts both feel conflicted.

On paper, tightwads and spendthrifts look very different. Tightwads are people who experience a lot of psychological distress when considering optional purchases. Spendthrifts are people who don’t experience enough distress when considering optional purchases. As you might imagine, tightwads are generally in a lot better shape financially than spendthrifts, based on just about any metric you can think of. However, tightwads and spendthrifts are more similar than they might appear at first glance: they both experience a lot of conflict and regret.

Tightwads consistently tell stories about purchases they wish they made. One example is a tightwad with a very high-paying job and a wife who loved going to fancy restaurants. He couldn’t psychologically cope with the prices at those restaurants, so on a special occasion, he took his wife to Ruby Tuesday. She was so disappointed that he regretted the decision for a long time.

We see comparable stories of regret from spendthrifts. Another example is a spendthrift who was in Chicago for a few days on a work trip and made his way to Saks Fifth Avenue. While there, he came across a beautiful pair of blue suede shoes that he thought might be a pretty snazzy addition to his teaching wardrobe. However, the salesperson politely informed him that they were driving loafers and weren’t meant for any formal event. He slept on the purchase for a few days and, in that time, managed to conjure up just enough potential usage occasions to justify the purchase. He never really got his money’s worth from these shoes, but they are nice to look at in the closet.

2. Financial opposites attract.

Normally, birds of a feather flock together. Republicans tend to marry Republicans, and Democrats tend to marry Democrats. However, if we don’t like something about ourselves, we tend to be turned off when we see someone else displaying that same disliked attribute. It can shine a really uncomfortable spotlight on our own problems. This is relevant to our story because tightwads and spendthrifts don’t like being tightwads and spendthrifts. In large surveys of married couples, we find that tightwads and spendthrifts are more likely to marry each other than they are to marry someone like themselves.

“The more that spouses differ on the tightwad-spendthrift dimension, the more they argue over money and the less satisfied they are with the marriage.”

These differences are probably fun and interesting at first. The tightwad might initially be amused and fascinated by how their spendthrift partner handles money and vice versa. However, as the relationship continues, and the financial decisions that partners confront start getting more serious, those differences can become irritating. Indeed, we find that the more that spouses differ on the tightwad-spendthrift dimension, the more they argue over money and the less satisfied they are with the marriage.

Sociologists also see this in their research on so-called “fatal attraction.” Sometimes, the very quality that initially attracts us to someone is the same quality that repels us later. It should be noted that tightwad-spendthrift marriages are not doomed, but these differences must be navigated carefully.

3. Complete financial transparency within relationships is overrated.

There’s a lot of concern in the personal finance world about “financial infidelity” within relationships. It sounds pretty bad, right? Infidelity. However, it shouldn’t be something we worry too much about because, for many financial experts, any behavior that falls short of complete, proactive transparency about how you’ve used money is considered financial infidelity. Imagine you go to the grocery store and buy $100 worth of groceries. You pay with a debit card and withdraw $20 in cash with your purchase, but you don’t report the cash withdrawal to your spouse. If your spouse sees the account activity, they’ll just think you spent $120 on groceries. They won’t know you had a secret $20 in cash to spend elsewhere. You have now officially committed an act of financial infidelity. This kind of rigid perspective isn’t useful. For most couples, learning exactly how your spouse spends money is likely to lead to more harm than good.

One problem is that many people have become convinced that small purchases are all that stand between them and becoming rich. This idea is commonly referred to as “the latte factor.” Simply put, if you could refrain from purchasing small indulgences, like the occasional latte, you could instead invest that money and become rich. Now, the math doesn’t really support this idea, but many people have come to believe it.

Complete transparency can shine an unnecessary spotlight on small purchases that seem more important than they actually are. Instead of financial transparency, choose financial translucency. Partners should have a general sense of how much money the other partner is spending per week or month, but the precise details of how that money is spent do not need to be proactively shared. A little bit of privacy is essential for maintaining a sense of individuality.

4. Don’t ask your spouse what kind of gift they want.

Who among us has not turned to the Internet every once in a while for some gift-giving advice? If you’re part of this group, you have no doubt encountered articles suggesting that you just ask the people in your life what kind of gift they would like and then give them the requested gift. This is well-meaning advice, meant to avoid gifts that are so bad that they shake the very foundation of the relationship. However, there are real problems with this “just ask” advice.

“If you want to give gifts that strengthen your relationship, you need to understand your partner’s inner psychological world.”

First of all, it’s really easy to get the timing and phrasing of that question all wrong. You can imagine someone saying to their partner, “Okay, I guess your birthday is coming up. You didn’t really like what I got you last year, so could you just tell me what to buy you this year?” How romantic! Second, a good gift requires some degree of surprise; why else would we use wrapping paper?

So, what’s a better approach to gift-giving? Within intimate relationships, gift-giving occasions are important opportunities to communicate how well we understand our partner. We all want to feel seen and understood. If you want to give gifts that strengthen your relationship, you need to understand your partner’s inner psychological world: what’s making them happy nowadays, what they’re looking forward to and what’s stressing them out. It’s a kind of understanding that partners can only achieve when they are curious about each other and periodically set aside some time to explore each other’s psychology. These are not conversations about who’s taking the kids to soccer or who’s going to call the plumber tomorrow. Those conversations are necessary in a functional household, but they’re not going to help you learn much about your partner. You also need to have conversations that aren’t about practical household matters.

5. Don’t just marry for love or money. Marry for well-being.

The Great Gatsby author F. Scott Fitzgerald once offered a famous piece of dating advice: “Don’t marry for money, go where the money is, then marry for love.” It’s not the worst advice. It correctly highlights that both love and money are essential. But let’s think carefully about the suggestion to “go where the money is.” That’s easier said than done, isn’t it? We spend most of our time around people with similar socioeconomic characteristics, and the upper echelons of society are not exactly throwing open their doors to welcome everyone in. Plus, let’s say you do find a partner with loads of money. Great! But are you sure they’re eager to share those resources with you? Plenty of people live in apparent luxury but feel cash-strapped because their partner believes in strict boundaries between their money and your money.

Money cannot be ignored, of course; the couple needs a certain amount to survive. Love is also essential; you absolutely need both. But love and money are not enough. You also need similar interests, values, plans, and dreams. Not identical, but similar enough. You can have all the love and money in the world, but if one partner wants to live on a farm and raise lots of children, and the other wants to live in the city and have no children, that’s a huge cause for concern. So, you should marry for well-being. Now, certainly, well-being requires having enough love and enough money within the relationship, but it also requires having enough psychological similarity.

To listen to the audio version read by author Scott Rick, download the Next Big Idea App today: