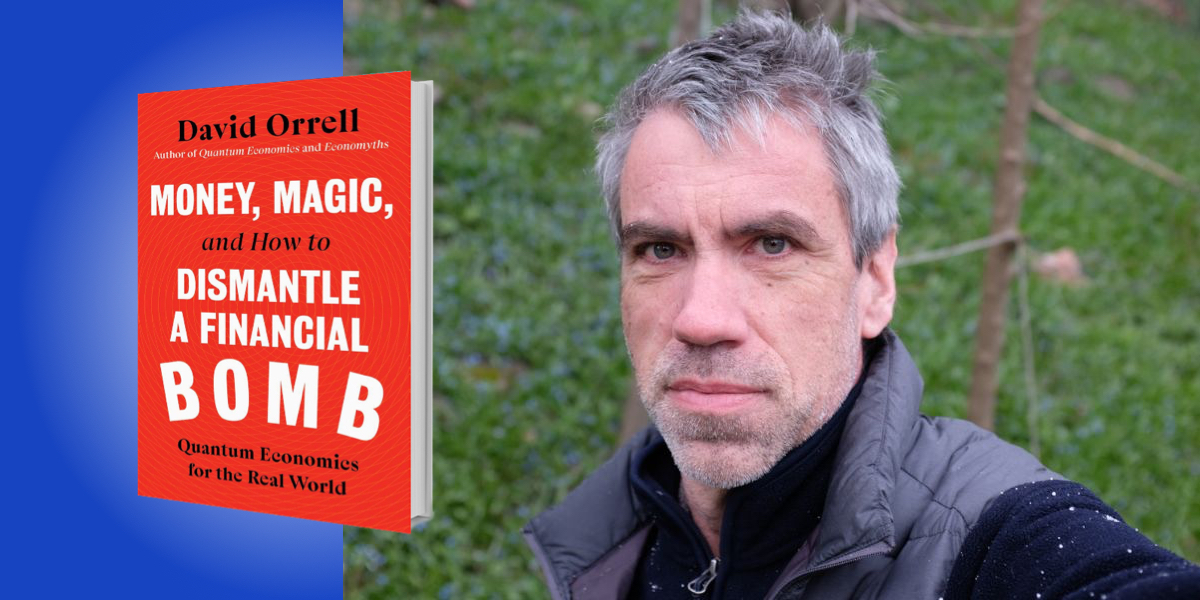

David Orrell is an applied mathematician and writer of books on science and economics. His books include Economyths: 11 Ways Economics Gets It Wrong and Quantum Economics: The New Science of Money.

Below, David shares 5 key insights from his new book, Money, Magic, and How to Dismantle a Financial Bomb: Quantum Economics for the Real World. Listen to the audio version—read by David himself—in the Next Big Idea App.

1. What does “quantum” even mean?

We usually associate “quantum” with weird and spooky phenomena, like an electron jumping from one place to another in a single leap, or a photon being mysteriously entangled with a twin on the other side of the universe. Or even with a cat being alive and dead at the same, as in the notorious thought experiment known as “Schrödinger’s cat” after the physicist who invented it.

However, the word “quantum” is from the Latin for “how much.” And in my book, I argue that it applies as well to the human world of the economy as it does to subatomic particles. After all, you don’t need a particle accelerator to know that money can jump from one spot to another in a single leap—it happens every time you tap your card at a store. Or to know that a loan contract can entangle you with your bank. While the economy isn’t alive and dead at the same time, we all know how it feels to hold conflicting ideas in our head at the same time. The same sense of intrinsic uncertainty applies quite visibly to the financial markets.

For example, a key idea in quantum physics is that the state of a particle is described by a so-called “quantum wave function,” which only specifies the probability that a particle will be observed at a particular location. The exact answer is only known after being observed through a measurement procedure. This sounds very strange and abstract when you’re talking about subatomic particles—but in the economy, it makes perfect sense.

If, say, you have your house up for sale, you might have a fuzzy idea of the value of your house, but it is better described in terms of probabilities; it will probably be worth about so much, plus or minus so much. The actual price is only discovered after a transaction, which plays the role of the measurement procedure. So money is a way of putting a hard number on the fuzzy notion of value. And that makes money not an inert medium of exchange—as it is portrayed in economics textbooks—but a remarkably complex substance whose behavior is often surprising and hard to predict.

2. Money is a kind of magic.

Money has long been associated with sorcery, and finance with alchemy. After all, how can something like a piece of paper with numbers on it be treated as if it were made of gold?

Money also has other apparently magical properties. It can be created out of the void—and vanish without so much as a puff of smoke. It can flash through space. It can grow without limit. And it can blow up without warning.

“Money can be created out of the void—and vanish without so much as a puff of smoke. It can flash through space. It can grow without limit. And it can blow up without warning.”

In fact, key features of our money system were invented by a group of 17th-century alchemists. They failed in their efforts to turn lead into gold, but they did find a way to turn paper into gold. Today, it is known as “fiat currency.”

But while money has apparently magical properties, this is a quantum form of magic. The science fiction writer Arthur C. Clarke wrote that a sufficiently advanced technology is indistinguishable from magic, and money is an advanced quantum technology.

Now, given that money was first invented nearly five thousand years ago in ancient Mesopotamia, it might seem strange to compare it with an advanced technology, let alone a quantum one. But money’s main trick is to put numbers on things, which is remarkable because numbers and things are very different. For example, physical things get old and decay, but numbers are forever. Your house might spring a leak in the roof, but the debt remains.

Money combines abstract numbers and human value into a single dualistic package. Just as a photon of light, according to quantum physics, is both a wave and a particle at the same time, so something like a coin or a banknote combines the property of a real, owned thing and an abstract number. And these dualistic properties feed up to affect the economy as a whole.

3. Mainstream economics—the kind that is taught in universities and shapes economic decision-making—is divorced from the real world, which is why we need a quantum alternative.

Mainstream economics views the economy as a rational machine, and downplays or ignores the role of money. Consider, for example, supply and demand, which are the bread and butter of economics. Any textbook includes an illustration of the famous X-shaped diagram, which shows a supply line that increases with price, and a demand line which decreases with price, intersecting at a single point that represents Adam Smith’s perfect equilibrium between supply and demand. These figures grace every textbook but appear also, in equation form, in the mathematical models used by economists to simulate the economy and inform policy decisions.

There is only one problem: if you look in these textbooks, you will never see an actual, empirical supply or demand line. And the reason is that they don’t exist. These are hypothetical quantities, which can never be independently determined, because all we can measure is actual transactions. And anyone who thinks that prices are drawn to a stable and optimal equilibrium hasn’t been watching markets very closely.

“Anyone who thinks that prices are drawn to a stable and optimal equilibrium hasn’t been watching markets very closely.”

In the quantum model, what counts is not supply or demand in isolation, but rather the propensity for buyers and sellers to transact at a particular price. This means that transactions are uncertain and are subject to dynamical forces, so the system is never at rest.

The quantum approach offers a more realistic picture of how transactions actually work, which is why quantum methods are catching on in the area of quantitative finance for things like the pricing of sophisticated financial derivatives. As The Economist magazine noted, the quantum model “better explains how investors think.” And they add that, “Such ideas may still sound abstract. But they will soon be physically embodied on trading floors.” By “physically embodied,” they of course mean quantum computers.

4. Just as the tools we use change the problems we set for ourselves, so the computers we use to model the economy change the way we think about the economy.

In the future, computers will increasingly be quantum, along with our mental models. Concepts such as superposition or entanglement seem obscure and magical when applied to subatomic particles, but quantum computers work by exploiting these properties to perform computations. Classical computers are based on bits, which can take on two values: 0 or 1. The quantum version of a bit is a qubit, and it can take on a continuous range of values. As one scientist put it, classical is like computing in black and white. Quantum is like computing in color—which makes a quantum computer potentially far more powerful than any classical device.

While quantum computing is still in an early stage of development, governments and industries are already starting to prepare for the quantum future, with finance and banking at the forefront. Most major banks now have a dedicated group working in the area of quantum computing, in part as an insurance policy against the possibility that someone else gets there before they do.

Now, mainstream or neoclassical economics got started in the late 19th century around the same time that the first computer was being designed, and it blossomed in the post-war period with the development of fast computers. The mechanistic way in which we think about the economy actually has more to do with the binary logic of computer bits than it does with the real world. Quantum economics is what happens when you apply quantum logic—in other words, the logic of quantum computing—to the economy.

For example, a basic lesson from quantum probability is that context matters, so we value things differently depending on the circumstances, or on how they are presented. This is responsible for things like the “endowment effect,” where we value what we own more highly than we otherwise would. In one famous experiment, subjects were given a mug, and then offered the chance to sell or exchange it. The researchers found that people demanded a median selling price of $7.12 in exchange for the mug, but only went for a median buying price of $2.87 to purchase the mug themselves. The change in context—in this case, from owning to not-owning—is enough to change the person’s mind about the object’s worth, in this case by a factor of about 2.5.

“Classical is like computing in black and white. Quantum is like computing in color.”

Such effects can be addressed to a degree by tweaking classical models, but make much more sense in the quantum approach, where context is a feature rather than a bug. And we are not talking about small or subtle adjustments to mainstream theory. In fact, a rule of thumb is that subjective context typically holds around an equal weight as objective calculations. If you find that careful exposition of the facts does not help in an argument with a friend or family member over one of their closely held beliefs, it may be that they are deploying quantum logic to support their opinion. Like the coffee mug, it’s their idea, and they don’t want to let it go.

The conflict between subjective desires and objective calculations comes to a head with the topic of money, which combines these two things in a single package. Unfortunately, we typically pay little attention to the dynamic and unstable nature of money, which is one reason we have trouble controlling or even understanding its behavior—as shown by the surprise among most economists at the recent surge in inflation.

5. Our economies are sitting on what amounts to a huge financial bomb.

Quantum mechanics found its first big real-world application during World War II, when it was used to harness the power of the atom in nuclear devices. The financial analogue of a nuclear device is runaway money creation in the economy.

Just as particles are created out of the void in physics, so money creation can be viewed as a quantum process. Take the example of real estate: private banks create new funds every time they issue a mortgage to buy a house. This newly created money adds to the amount of money in circulation, but most of it ends up in real estate, where it drives up the price of houses. The economy, therefore, experiences asset price inflation, in a financial version of what magicians call a levitation trick, when they make a person or object magically float in the air. We can thank those 17th-century alchemists for coming up with the idea.

In the economy, though, this price levitation has real consequences. It contributes to inequality, because rich people tend to own more and larger homes. It also leads to financial instability, as a number of places, including Canada, are now discovering.

To listen to the audio version read by author David Orrell, download the Next Big Idea App today: