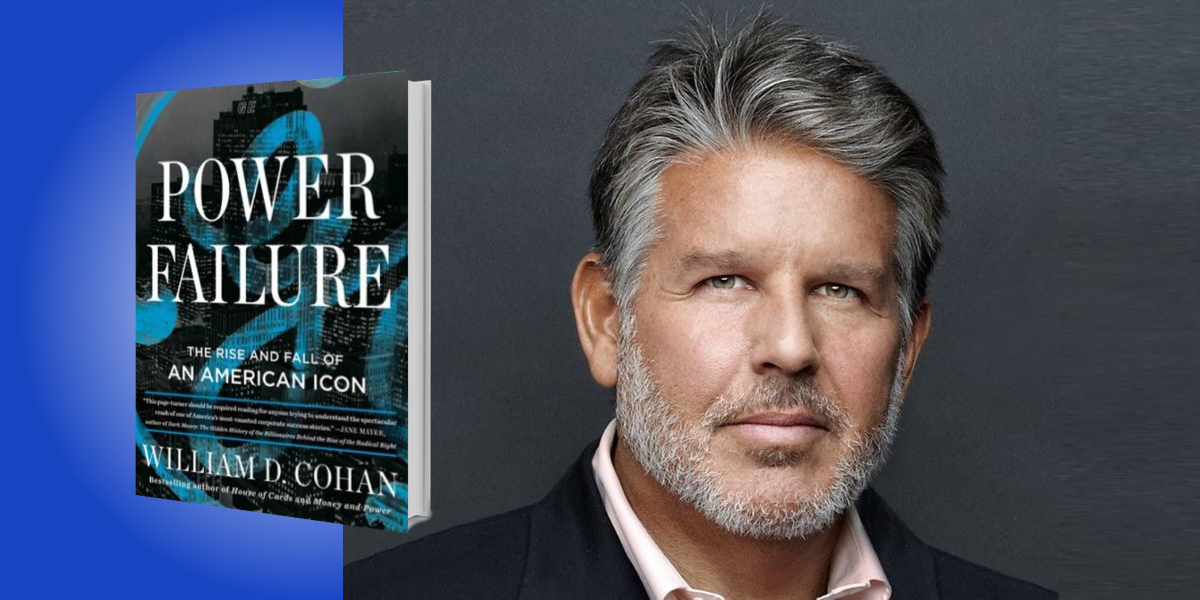

William D. Cohan is the author of seven books. A founding partner of Puck, the new digital media company, he has written for The New York Times, the Financial Times, Air Mail, Town & Country, Rolling Stone, and others. His latest book, Power Failure, was named one of the best books of the year by the New Yorker, the Financial Times, and the Economist.

William recently appeared on The Next Big Idea podcast to discuss the book with our curator Malcolm Gladwell. Listen to their full conversation and get episode highlights here.

Below, William shares 5 key insights from his new book, Power Failure: The Rise and Fall of an American Icon. Listen to the audio version—read by William himself—in the Next Big Idea App.

1. The choice of a CEO matters—a lot.

Jack Welch, of course, was the legendary CEO of General Electric, running the company from 1981 to 2001. During that time, GE’s market value increased from $12 billion when he took over to more than $600 billion about a year before Jack retired. He chose as his successor Jeff Immelt, who had run GE’s medical equipment business, after a very highly publicized and lengthy competition between Jeff Immelt, Jim McNerney, and Robert Nardelli.

Jack told me that he chose Jeff because he thought Jeff would do the best job and was the best qualified. But he quickly soured on Jeff. During our very first meeting together, he made no bones about his view that he had made a terrible mistake in choosing Jeff. By the fall of 2018, when we had our first of many conversations—this was about a year and a half before Jack died—GE was nothing like the company Jack had turned over to Jeff on September 7, 2001.

Jack had many criticisms of Jeff: he didn’t listen to people, he didn’t understand finance, he overpaid for acquisitions, he panicked, the missed earnings estimates when he should have made them. The irony, of course, is that Jack was the one who selected Jeff. For him to be so disappointed with his successor, so dismayed by what had become of GE under Jeff’s leadership, led me to wonder: How could he have made such a big mistake?

“[Jack] didn’t really have a good explanation for what had happened, other than acknowledging he’d been susceptible to Jeff’s political skills, his sucking-up.”

Choosing a worthy, capable heir should have been Jack’s last act of service to the company he’d led for twenty years. He realized this, but he didn’t really have a good explanation for what had happened, other than acknowledging he’d been susceptible to Jeff’s political skills, his sucking-up. Jack did, however, admit that he’d made a terrible mistake, one that would forever tarnish his legacy.

2. A CEO must understand finance, especially if half of your company’s profits come from making money from money.

Jeff Immelt was a very smart fellow. He’d graduated from Dartmouth College and Harvard Business School. But he didn’t understand finance as well as he thought he did. And he had an incredible amount of success at GE, mostly by generating revenue and sales, but he did not really understand GE Capital, GE’s big finance business. GE Capital was one of the largest financial institutions in the world, generating roughly 40 percent to 50 percent of GE’s earnings in any given year.

GE got into the finance business during the Great Depression. When its customers could no longer afford to buy the appliances that GE was selling, the company helped them finance their purchases. That eventually developed into a huge finance operation that made billions of dollars.

Truth be told, Jeff did not really understand the risks that were inherent in that business. And when the 2008 financial crisis came along, it was too late to do anything about the risks that GE Capital faced. I discovered in the reporting of this book that GE Capital almost filed for bankruptcy twice, which is a remarkable thing nobody knew about. It was only able to stave off bankruptcy by participating in a number of government-sponsored lending and guarantee programs.

Ultimately, Jeff Immelt decided to sell off GE Capital—but without it, the company had no way to replace those earnings.

3. As CEO you have to be willing to encourage opposing points of view, even if you don’t agree with them.

If you don’t encourage opposing points of view, you end up coming off like the smartest guy in the room, someone who doesn’t care about the views of your top executives. People at that level who feel like they’re not being heard will often leave and find new jobs, which happened all too often during Jeff Immelt’s time as the CEO of GE.

“If you don’t encourage opposing points of view, you end up coming off like the smartest guy in the room, someone who doesn’t care about the views of your top executives.”

People like John Krenicki, who was running the power business at GE—and running it very well—objected to something Jeff was calling “the global growth initiative,” which was a way to push down more responsibility to various country managers in the 150 or so countries that GE did business, empowering them to make decisions on contracts and new business without having to go back and get the approval of people in headquarters in Fairfield, Connecticut, or at the various business units. Executives like John Krenick felt their power was being usurped, objected strenuously to this rearrangement, and expressed that view to Jeff. But Jeff had made his decision and didn’t want to listen to opposing views. John Krenicki ended up leaving the company and went on to a very successful career in private equity.

Another example is Michael Pralle who ran GE Capital’s real estate finance business. In 2007, as the financial crisis looked like it was unfolding, Michael told Jeff Immelt that he believed the time was perfect for GE to sell its real estate business. Jeff disagreed. He waved around a McKinsey study he’d commissioned that said the real estate market would continue to thrive. Of course, less than a year later, the real estate market crashed and GE Capital lost a tremendous amount of value—value it could have preserved had Jeff been willing to listen.

4. Don’t get so wrapped up in the idea of buying or selling a business that you lose sight of what you’re getting in return.

Jack Welch paid something like $600 million to acquire the financial services firm Kidder, Peabody & Co. This was in 1986, a terrible time to buy Kidder, Peabody & Co.—that deal turned out to be a terrible one for GE. But Jack ended up getting his money back. He sold Kidder, Peabody & Co. to PaineWebber. When UBS then bought PaineWebber for $10 billion, GE made about $2 billion on its PaineWebber stock. He got lucky.

“Usually, if you were looking to divest such a unique and valuable property, you’d run an auction and try to drive up the sale price.”

Jeff Immelt was less lucky. He overpaid terribly for Alstom, the assets of the French power company that GE bought around 2014. That business has been an albatross around GE’s neck ever since. And in the 2008 financial crisis, as GE was struggling mightily to keep afloat, Jeff decided to sell NBC Universal—its television, film studio, and theme park business—to Comcast in a deal worth about $30 billion. Usually, if you were looking to divest such a unique and valuable property, you’d run an auction and try to drive up the sale price. Jeff opted not to do that, and it cost him. Within a few years, Comcast turned NBC Universal into something worth around $100 billion.

Those two deals—overpaying for Alstom and selling NBCUniversal too cheaply—are generally regarded as among the two worst ever.

5. Don’t invite the fox into the henhouse.

In 2015, after the Alstom deal was complete and Jeff had announced the sale of GE Capital, he invited Trian Capital Partners, a hedge fund run by Nelson Peltz and his son-in-law Ed Garden to buy a $2.5 billion stake in GE. I think Jeff thought it would be a way to ratify his strategic brilliance in buying Alstom and in announcing the sale of GE Capital.

Jeff thought that Nelson and Ed would be friends. He had known Ed for a long time: Ed’s brother had been a classmate of his at Dartmouth; Jeff used to go to the Garden’s home in Melrose, Massachusetts, for holidays. I think he thought that Trian would be a quiescent presence. It turned out to be exactly the opposite. When Jeff was unable to replace the earnings that he lost by selling GE Capital and the company’s stock price nosedived, Trian began to bare its teeth and, in June 2018, pushed for Jeff’s departure of Jeff Immelt as CEO after 17 years.

To listen to the audio version read by author William D. Cohan, download the Next Big Idea App today: