Below, co-authors John Campbell and Tarun Ramadorai share five key insights from their new book, Fixed: Why Personal Finance Is Broken and How to Make It Work for Everyone.

John is an economics professor at Harvard who specializes in personal finance, which he teaches to over 300 undergraduates each fall. Tarun is a professor of financial economics at Imperial College Business School in London.

What’s the big idea?

Personal finance is unnecessarily complex and often rigged in favor of the financially savvy and already well-off. There is a serious lack of financial education and guidance to protect everyone else from the most common, damaging mistakes. Regulations are required to make financial products simple, safe, and fair for everyone.

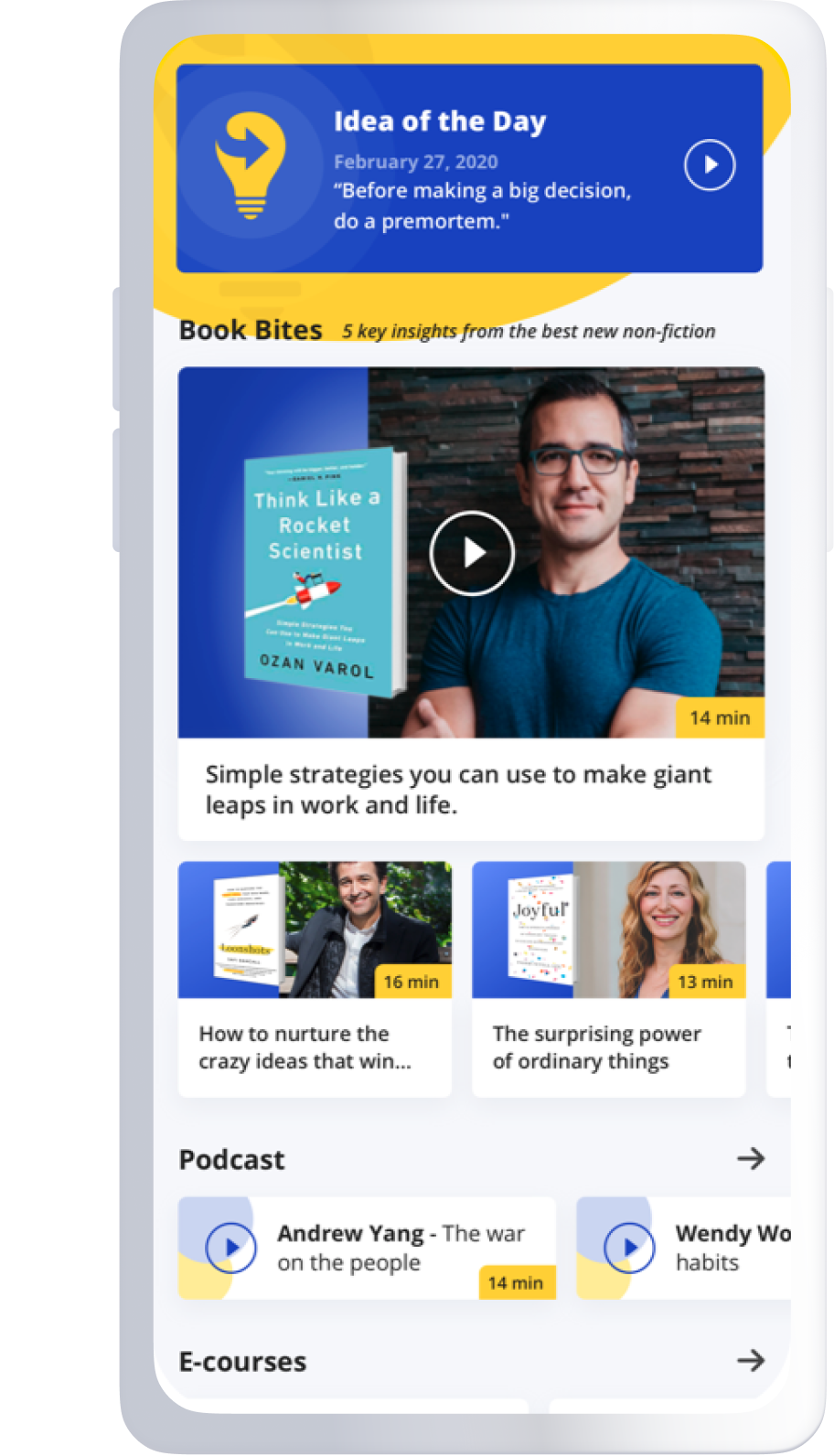

Listen to the audio version of this Book Bite—read by John—below, or in the Next Big Idea App.

1. Personal finance is too difficult, and it doesn’t have to be.

Managing personal finances is one of the most important tasks in adult life. But most of us dislike financial planning and are reluctant to shop for financial products or manage them carefully. Personal finance feels difficult, and financial institutions untrustworthy.

Many books try persuading us to study harder and work harder so we can master personal finance. I call this the “personal finance for dummies” approach. But we think the problem is structural, caused by the way capitalism works in the personal finance context. We summarize the problem using the word “Fixed” in our title. “Fixed” has two meanings:

- The “fixed” or “rigged” state of our current financial system, working to the advantage of its savvy operators in a way that is unfair and imperfectly understood by its victims.

- Our belief that the personal finance system can be “fixed” in the sense that a broken machine can be repaired.

Our book is unique in this focus on the personal finance system, and how to repair it. We offer specific reforms that we think will make everyone’s financial life much easier.

2. The mistakes we make corrupt the financial system.

Financial calculations don’t come naturally to most people, and financial education is woefully inadequate. The simple ways we learn many things—from our own experience, and the experiences of our friends—don’t work well in personal finance because the outcomes of financial decisions can be long delayed and affected by random events. As a result, people often make mistakes when they pick financial products and later when they use them. Many people also resist shopping around, preferring to do business with a financial company they are familiar with.

These tendencies corrupt the financial system. Instead of competing aggressively with one another to offer high-quality products at the lowest possible prices, financial firms often find it more profitable to sell products with disguised flaws and hidden costs, competing through branding rather than quality or price. When some customers make expensive mistakes (like paying multiple overdraft fees on a bank account or failing to refinance their mortgages promptly) these customers generate revenue for the financial industry that enables firms to lower their up-front prices. Consequently, the least-informed customers subsidize free checking, credit card rewards, and low mortgage rates for the best-informed customers—who are typically better off to start with. In this way, personal finance contributes to the wealth inequality that is such a striking feature of the world today.

3. These problems are just getting bigger.

The problems I’ve described are not new, but their impact is greater than ever. People live longer than they used to, and in smaller families. That means they have to save more for a longer retirement without being able to rely so much on help from younger relatives. And many big-ticket items, from higher education to housing, are more expensive than they used to be, which makes it more important to be able to borrow at a reasonable cost to finance these purchases.

“Personal finance contributes to the wealth inequality that is such a striking feature of the world today.”

Taking a global perspective, the last half-century has seen the emergence of a vast new middle class in formerly poor countries such as China and India. Billions of people now live in an economy that asks them to use personal finance products, but they have very little experience with personal finance and are particularly vulnerable to exploitation.

Some people react to this situation by opting out of the formal financial system. They may keep their savings in cash “under the mattress,” borrow from friends and family, turn to loan sharks, or invest in cryptocurrencies. Unfortunately, these alternatives are even worse: these people are jumping out of the frying pan and into the fire.

4. Technology won’t solve these problems by itself.

Fintech is the application of technology to financial products. Fintech makes it much cheaper for financial firms to offer small-scale products to customers with modest resources, and to customize those products to meet individual needs. Fintech also makes it easier for shoppers to compare the various products on offer in the marketplace.

Unfortunately, fintech can be used for bad as well as for good. It can be used to target human weaknesses, for example, by making stock trading feel like playing a game on a smartphone or by offering instant “buy now, pay later” credit that encourages impulse spending. It can also be used to charge high prices to customers who are particularly likely to accept them, to outrun traditional regulations that limit abuse, and to undermine laws against discrimination. We believe that fintech will only improve matters if the fundamentals of the personal finance system are sound. It’s like a turbocharger that should only be installed on a car once the chassis is strong enough to accommodate it.

5. We need forward-looking financial regulation with a focus on product design.

Financial regulation should be carefully targeted to require that financial firms offer products that are simple, safe, cheap, and easy for people to manage. We call the suite of such products the “starter kit,” by analogy with sporting equipment that everyone needs to be safe and competitive on a playing field.

“These products will be easy to shop for because they are standardized.”

Our vision is that financial firms active in a particular market segment can offer whatever products they want, but must also offer starter-kit products whose design and fee structure (but not the level of fees) is specified by regulators in advance. These products will be easy to shop for because they are standardized, just as over-the-counter painkillers are easy to find and compare on a pharmacy shelf. Then, competition will work as it is supposed to, making starter-kit products available at low prices.

Some financial products are so important that we advocate going further and mandating that consumers select one product from the menu on offer. For example, we believe that in the U.S. (where Social Security provides inadequate retirement income for middle- and upper-income families), people should be required to open a single tax-advantaged retirement account at the date of first employment that they can use throughout their working lives.

We are aware that consumer financial regulation is in retreat in both the U.S. and the UK at present. In part, this is the wheel of political fortune turning, but in part it is due to a conception of consumer financial protection that has been too vague and retrospective. Forward-looking regulation, focused on the specifics of product design, has a better chance to win broad political acceptance and ultimately transform personal finance so that it works for everyone.

Enjoy our full library of Book Bites—read by the authors!—in the Next Big Idea App: