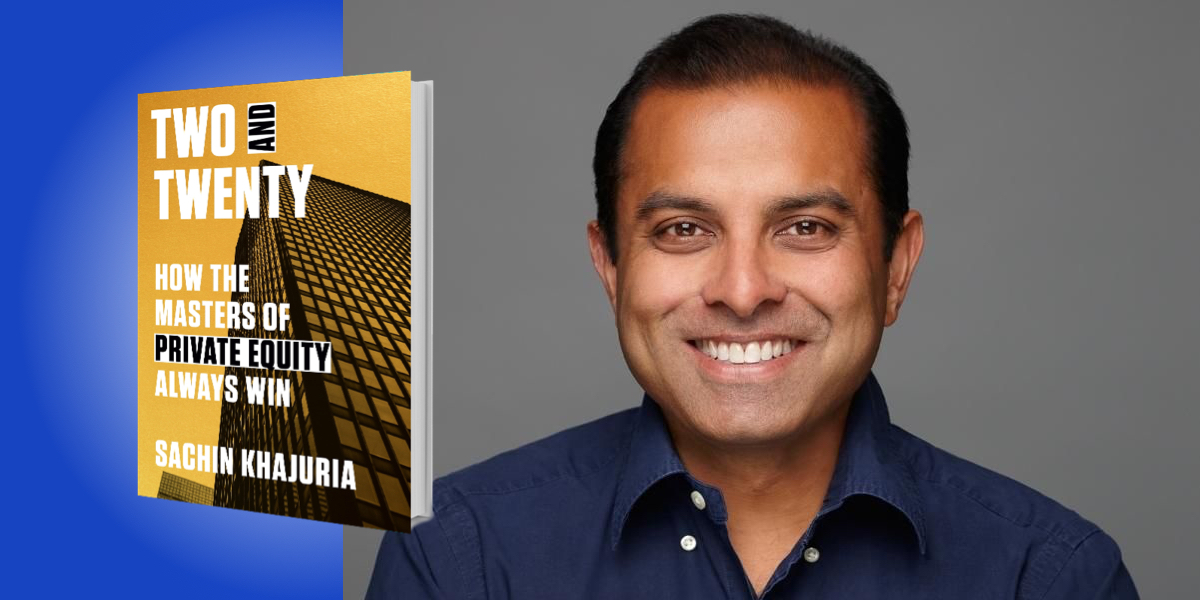

Sachin Khajuria is a former partner at Apollo Global Management, an asset manager serving prominent investors from around the world. He has been investing in private equity for 25 years, including funds managed by Blackstone and Carlyle, among other firms.

Below, Sachin shares 5 key insights from his new book, Two and Twenty: How the Masters of Private Equity Always Win. Listen to the audio version—read by Sachin himself—in the Next Big Idea App.

1. We’re in the Age of Big Finance.

Just like investing in stocks and bonds for retirement, private equity has entered the mainstream. It’s not some obscure corner of Wall Street—it’s Main Street. Private equity invests in businesses on behalf of investors (like pension funds), works to improve them, and exits them for profit. Today, the wealth controlled by private equity firms surpasses the GDP of some nations. After huge growth in recent years, profiting through the financial crisis and the COVID-19 pandemic, private markets are a $12 trillion industry. Through the next decade, this could grow to over $20 trillion.

The rise of private equity has occurred in stealth. Big Tech firms of Silicon Valley have become household names, like Apple, Microsoft, Amazon, and Google. We’ve heard a lot about Big Pharma through the COVID-19 pandemic—like Pfizer. What about private equity firms? Are you familiar with Blackstone, or Carlyle, or Silver Lake? We are all customers of private equity. If you have a pension plan, its funds are likely to be invested in private equity. Even by just consuming everyday products or services owned or invested in with money from private equity firms, you are playing a part in the industry.

Private equity invests in all kinds of industries, from health care to cable TV to chemicals to banks and insurance. It’s all over the economy. It’s in niches from kindergartens to dating apps, from cyber security to college textbooks. What do Hilton hotels, Twinkies, Barnes & Noble bookstores, the real Top Gun fighter jet training school, and soccer club Chelsea FC have in common? They are all private equity deals. This is Big Finance.

We are on the horizon of a shift in retail investing. In the coming years, we will see private equity play a bigger role in individuals’ investment portfolios, alongside traditional assets such as stocks and bonds. The democratization of finance in other sectors (including stock trading and crypto) is coming to private equity. The investment portfolio of tomorrow could hold at least twenty percent of its assets in private markets—which means trillions of dollars more for the major private equity firms to manage. This is coming to your door.

“Today, the wealth controlled by private equity firms surpasses the GDP of some nations.”

2. Understand private equity NOW.

We’re at the tipping point. It’s time investors (especially retail investors) understood how private equity works in practice. How deals are done behind the scenes. How billions of dollars of investors’ money per deal are on the move within weeks. It’s essential for investors to understand how companies are bought and sold, how investments are fixed when they go wrong, and how smart ideas that might seem obvious today once started out. We need to understand what it means to invest through Blackstone, not just through BlackRock.

For example, COVID-19 directly impacted many sectors of the economy: travel, hospitality, and education, to name a few. Governments were focused on keeping the financial system working and supporting workers. They weren’t as focused on individual businesses. Enter private equity, buying into and lending capital to lots of these kinds of companies, often taking control as owners. This year, observe the pullback in Big Tech stocks. And the Elon Musk/Twitter deal—it’s essentially a potential leveraged buyout, and this time it’s private equity that’s looking to be part of the financing.

3. Private equity professionals eat what they cook.

Private equity is a people business. There’s nothing automated, nothing that a supercomputer or artificial intelligence can replace. It’s active investing, not market tracking. The connective tissue is investment professionals working on deals. These people have skin in the game because they are incentivized on the outcome of investments through a personal equity stake, not just when deals close, like a banker or consultant. They think and act like principals, not advisors. They behave as engaged owners—they eat what they cook. Their ingrained sense of personal ownership makes the difference. Outcome-based financial incentives in private equity underpin the alignment between investment professionals and their investors. The folks doing the deals get paid when those who put up most of the money get paid—they win together. This symbiosis is critical to success.

“The folks doing the deals get paid when those who put up most of the money get paid—they win together. This symbiosis is critical to success.”

When investment professionals buy into a company or lend to it as a creditor, they will think and act as if they are the owners of the business. It’s like the deal they have sunk investors’ money into is not only the center of their demanding job, it’s an important part of their lives. It might take five or 10 years to exit the investment. Compared to the raw emotion of ownership that an entrepreneur might have, this feeling of ownership is more nuanced in private equity. Investment professionals can detach when analyzing problems, and when selling out. They walk this tightrope because their eyes are fixed on the outcome.

Let’s look at a deal story to illustrate this. In the recession following the financial crisis, the insurance sector was looked at by investors with suspicion. What if every insurer was like AIG, with grenades lurking beneath the surface? A handful of smart private equity firms realized that during a recession, investing in a sector that was not directly correlated to the economy could be a good move. Some of these firms invested in insurance businesses, only to witness some of the worst years for natural catastrophes: the Tokyo earthquake and tsunami, hurricanes in the Atlantic, fires in Australia, and so on. Private equity didn’t shrug their shoulders at factors clearly outside of their control. They changed the pathway to their goal, and the time horizon, but not the final result they were expecting. They dug in and kept going, where many public companies would have bailed out. Today, the insurance sector is a major destination for private equity investment.

4. Harness the winning mindset in private equity.

Success in private equity is driven by a winning psychology. This mindset leads some investment firms and funds to outperform their competitors and public markets. I have identified traits, principles, and culture found among the most successful investors in this industry. Based on the core tenet of thinking like a principal, not an advisor, the following are three of the key success drivers.

First: the ability to identify, analyze, and harness complexity as a source of value for investments. How to run into a burning building during a big shock to the economy, while others are preoccupied putting out fires. How to invest during the volatile start of 2022. How chaos can be profit in disguise.

“Temperament is perhaps the most important yet most overlooked driver of long-term success.”

Second: temperament is perhaps the most important yet most overlooked driver of long-term success. How to keep calm and focused on investments that can take up to a decade to deliver results. How to pivot when things go wrong, making decisions swiftly based on data that has been collected over years and is updated in real time from a portfolio that spans the economy.

Third: the major private equity firms keep evolving to stay ahead. An example is private equity firms taking up the white spaces left behind by banks—like direct lending to companies as a long-term credit provider. How each part of the business plan of major firms is being opened to new markets, new clients, and new commitments to manage investors’ money. How the major firms are firing on all cylinders.

5. Society needs engagement with private equity, not an adversarial approach.

At a macro level, we are past the point where the dialogue about private equity should be cast as whether they’re good or bad. That ship has sailed. Private markets play an integral role in funding the retirees of tomorrow, and this role is growing. Our engagement with and understanding of private markets needs to grow alongside the growth of the industry. We need to learn about how private equity influences our economy, transforming businesses and companies to help them grow profitably and become more efficient. Perhaps we do need to regulate private equity differently, or tax its activities differently, but ahead of that discussion comes better collective understanding of this growth engine for our economy. We stand a better chance of improving what we understand.

At a micro level, we each need to be confident enough to select the investment firms and funds that work well for our financial goals. We need to be comfortable answering a fundamental question when we consider investing in private markets: Am I being adequately compensated in investment returns for the investment risks I’m taking? Ask yourself: What do I really know about private equity? Your answer will be your call to action.

To listen to the audio version read by author Sachin Khajuria, download the Next Big Idea App today: